The Sneaker Economy: When Footwear Becomes an Investment

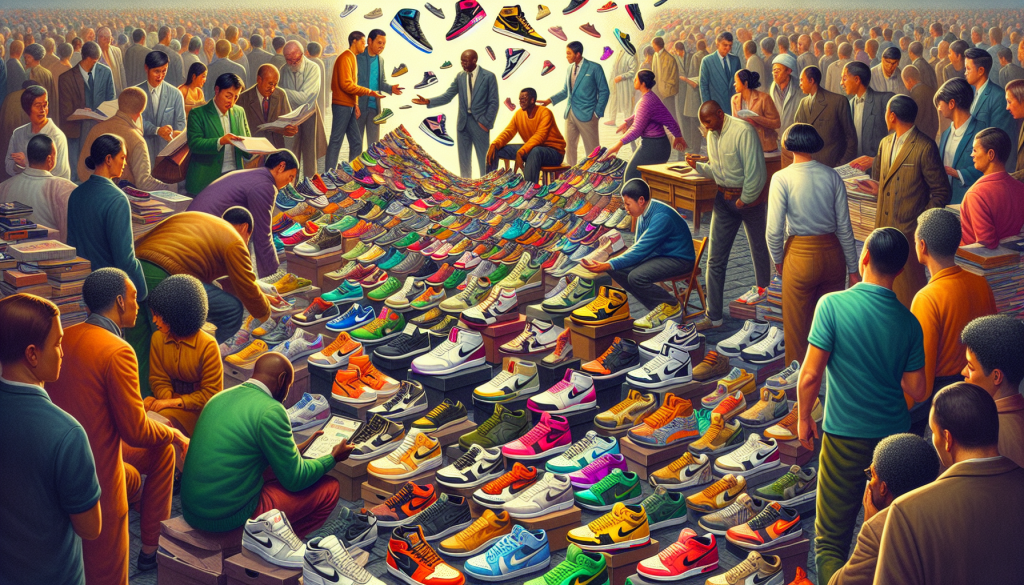

In recent years, the sneaker industry has boomed into a global phenomenon. What once started as a basic necessity for feet has now become a highly coveted collectible item, with prices reaching thousands of dollars. The sneaker economy, also known as the sneaker resale market, is thriving as more and more people are investing in rare and limited edition kicks. In this article, we’ll take a closer look at the sneaker economy, what drives it, and why sneakers have become a hot commodity for investors.

The Rise of Sneaker Culture

The sneaker industry has come a long way since its humble beginnings in the 19th century. What started out as basic rubber-soled shoes designed for athletic purposes has now evolved into a multi-billion dollar market. Sneakers have become a fashion statement, a cultural symbol, and a status symbol, especially in the world of streetwear and hip-hop culture.

Sneakerheads, a term used to describe avid sneaker collectors, have been around for decades. But the rise of social media and e-commerce platforms has made it easier for sneaker enthusiasts to connect and trade their coveted kicks. This led to a surge in the sneaker economy, with an estimated worth of $2 billion in the global resale market.

The Driving Forces Behind the Sneaker Economy

One of the main factors driving the sneaker economy is the limited edition releases. Brands like Nike, Adidas, and Jordan have mastered the art of creating hype around their limited edition releases, often collaborating with celebrities and designers to create highly sought-after sneakers. This scarcity creates a demand for these kicks, with supply unable to keep up, resulting in skyrocketing resale prices.

Another driving force is the rise of sneaker culture and its influence on fashion. Sneakers are no longer just for athletes and sneakerheads. They have become a staple in streetwear fashion, with celebrities and influencers sporting the latest and rarest sneakers. This trend has made sneakers more desirable, and the resale market has taken notice.

Sneaker Investment: The Pros and Cons

With resale prices soaring to thousands of dollars, many people are now investing in sneakers as an alternative asset class. Some consider it a viable investment opportunity, with the potential for high returns. However, like any investment, there are risks involved.

On the pro side, the sneaker market has shown a steady increase in value over the years. In 2019, one pair of Nike’s “Moon Shoe” sold for a record-breaking $437,000 at an auction. Some limited edition releases have also proved to be profitable investments, with their prices increasing significantly within a short period of time.

On the con side, investing in sneakers requires a great deal of knowledge and research. It’s not enough to just buy a limited edition release and expect it to increase in value. It’s essential to understand the trends, the market demand, and the resale potential of each sneaker. There’s also the risk of buying counterfeit or fake sneakers, which can be detrimental to your investment.

The Future of the Sneaker Economy

It’s safe to say that the sneaker economy is here to stay. As long as there is a demand for limited edition releases and the influence of sneaker culture on fashion, the market will continue to thrive. Brands are also catching on to the resale market and are incorporating it into their business strategies by releasing more limited edition drops. This ensures that the demand for these highly coveted kicks will only increase in the future.

In conclusion, the sneaker economy has evolved from a niche market into a profitable investment opportunity. With limited edition releases, the rise of sneaker culture, and the potential for high returns, it’s no surprise that sneakers have become more than just footwear – they have become an investment.