The Hidden Costs of Car Ownership: What the Sticker Price Doesn’t Tell You

The Hidden Costs of Car Ownership: What the Sticker Price Doesn’t Tell You

When most people think of the cost of owning a car, they often only consider the sticker price. The amount listed on the windshield or in the sales ad is just the beginning. While it may seem like a good deal at first, there are many additional costs that come with owning a car that are not reflected in that initial price. These hidden costs can add up over time and greatly impact your budget. In this article, we will explore some of the hidden costs of car ownership that you may not have considered.

Depreciation

One of the biggest hidden costs of car ownership is depreciation. As soon as you drive a new car off the lot, it begins to lose value. According to Edmunds, a new car can lose up to 20% of its value in the first year and up to 60% over the first five years of ownership. This means that even if you paid $30,000 for a new car, it could be worth only $12,000 after five years. That’s a loss of $18,000! This depreciation affects your wallet in two ways: lower resale value if you decide to sell your car and higher costs if you trade it in for a new one.

Insurance

Car insurance is a necessary and often hefty expense for car owners. While the cost of insurance varies based on factors such as location, driving record, and type of car, it is an ongoing cost that should be factored into the overall cost of car ownership. In addition, the more expensive the car, the higher the insurance premium will be. It’s important to shop around for insurance to ensure you are getting the best deal, but it’s also important to have enough coverage to protect your investment.

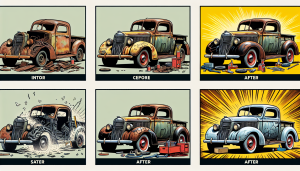

Maintenance and Repairs

Regular maintenance and the occasional repair are part of owning a car. However, these costs can add up quickly, especially for older or high-end vehicles. It’s important to keep up with routine maintenance, such as oil changes and tire rotations, to ensure your car runs smoothly and avoid any costly repairs down the road. And if you do need to make repairs, they can be expensive. According to CarMD, the average cost of a car repair in 2019 was $392. These unexpected expenses can significantly impact your budget if you are not prepared for them.

Fuel and Taxes

Fuel costs and taxes are two additional hidden costs of car ownership. The amount you spend on gas each month can greatly vary based on your driving habits and the type of car you own. In addition, many states have automobile taxes or registration fees that can add up over time. It’s crucial to research the fuel economy of the car you are considering purchasing and factor in any taxes or fees specific to your location.

Conclusion

As you can see, the hidden costs of car ownership can quickly add up and have a significant impact on your budget. When considering buying a car, it’s important to look beyond the sticker price and take into account depreciation, insurance, maintenance and repairs, fuel costs, and taxes. By being aware of these hidden costs, you can make a more informed decision and better plan for the financial responsibility of owning a car.

Remember to always do your research and budget accordingly to avoid any surprises down the road. While a car may seem like a great deal at first, the hidden costs may end up outweighing the initial savings. Consider these factors carefully when making your next car purchase.

Thank you for reading!